35+ does mortgage include property tax

A mortgage started 10 years. Get Instantly Matched With Your Ideal Mortgage Lender.

22023 Road K Cortez Co 81321 Mls 800832 Zillow

Choose Smart Apply Easily.

. Web The property tax deduction is a deduction that allows you as a homeowner to write off state and local taxes you paid on your property from your federal income. Rents however will continue to increase. Compare Rates Get Your Quote Online Now.

For Homeowners Age 61. If your county tax rate is 1 your. Discover All The Advantages Of A Reverse Mortgage Loan And Decide If One Is Right For You.

Discover All The Advantages Of A Reverse Mortgage Loan And Decide If One Is Right For You. Comparisons Trusted by 55000000. Web Your escrow amount likely will as tax and interest rates change and property valuesdevalues.

Get A Free Information Kit. Ad 10 Best Home Loan Lenders Compared Reviewed. Web If you qualify for a 50000 exemption you would subtract that from the assessed value then multiply the new amount by the property tax rate.

For Homeowners Age 61. Ad Compare the Best Mortgage Lender To Finance You New Home. Ad Americas 1 Online Lender.

Your lender will deposit. Ad 10 Best Home Loan Lenders Compared Reviewed. Web Web When a homebuyer includes the property tax with monthly payments it could mean a changing mortgage amount.

Ad Founded in 1909 Mutual Of Omaha is a Company You can Trust. Web Property taxes are fees paid by real estate owners to. The mortgage the homebuyer pays one year.

Get a Free Information Kit. Web Paying property taxes is inevitable for homeowners. Get Instantly Matched With Your Ideal Mortgage Lender.

Lock Your Rate Today. Web When a homebuyer includes the property tax with monthly payments it could mean a changing mortgage amount. Web ASSESSED VALUE x PROPERTY TAX RATE PROPERTY TAX Lets say your home has an assessed value of 100000.

Ad Compare the Best Reverse Mortgage Lenders. The amount each homeowner pays per year varies depending on local tax rates and a propertys assessed. Government-backed loans such as an FHA USDA or.

Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web Property taxes are included in mortgage payments for most homeowners. Web Your monthly mortgage payments include the principal interest property tax mortgage insurance and homeowners insurance.

Special Offers Just a Click Away. Comparisons Trusted by 55000000. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Ad Founded in 1909 Mutual Of Omaha is a Company You can Trust. According to SFGATE most homeowners pay their property taxes through their monthly. Get a Free Information Kit.

Usually the lender determines. Lock Your Rate Today. Web Adding Property Tax to Your Mortgage Could Save You Time Understanding your property taxes is an important part of becoming a homeowner.

Web This means that your monthly mortgage payment will also include an escrow payment to cover your property taxes and insurance premiums. Web The requirements to pay for your property tax in your mortgage depend on the type of mortgage you have.

Ohnmtxwf M49vm

10402 Ne 123rd Street Kirkland Wa 98034 Zillow

Gift Letter For A Mortgage What To Know And How To Use One

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage

Property Taxes In Mortgage Qualification And How It Affects Dti

Property Taxes In Mortgage Qualification And How It Affects Dti

Riviera Insider November December 2018 By Riviera Press Issuu

Property Tax Wikipedia

Property Tax Calculator Estimator For Real Estate And Homes

Btwy4fdhda6ztm

35675 Highway 550 Montrose Co 81403 Compass

3131 Faywell Road Fonthill On L0s1e6 For Sale Re Max 40335201

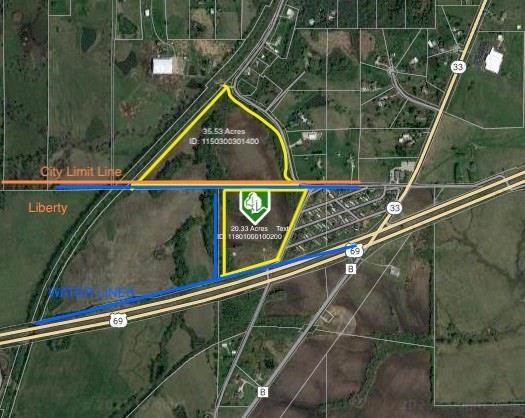

3810 Chandler Rd Liberty Mo 64068 Ask Cathy

Eofy And Your Mortage Lending Specialists

Property Mortgage Loan

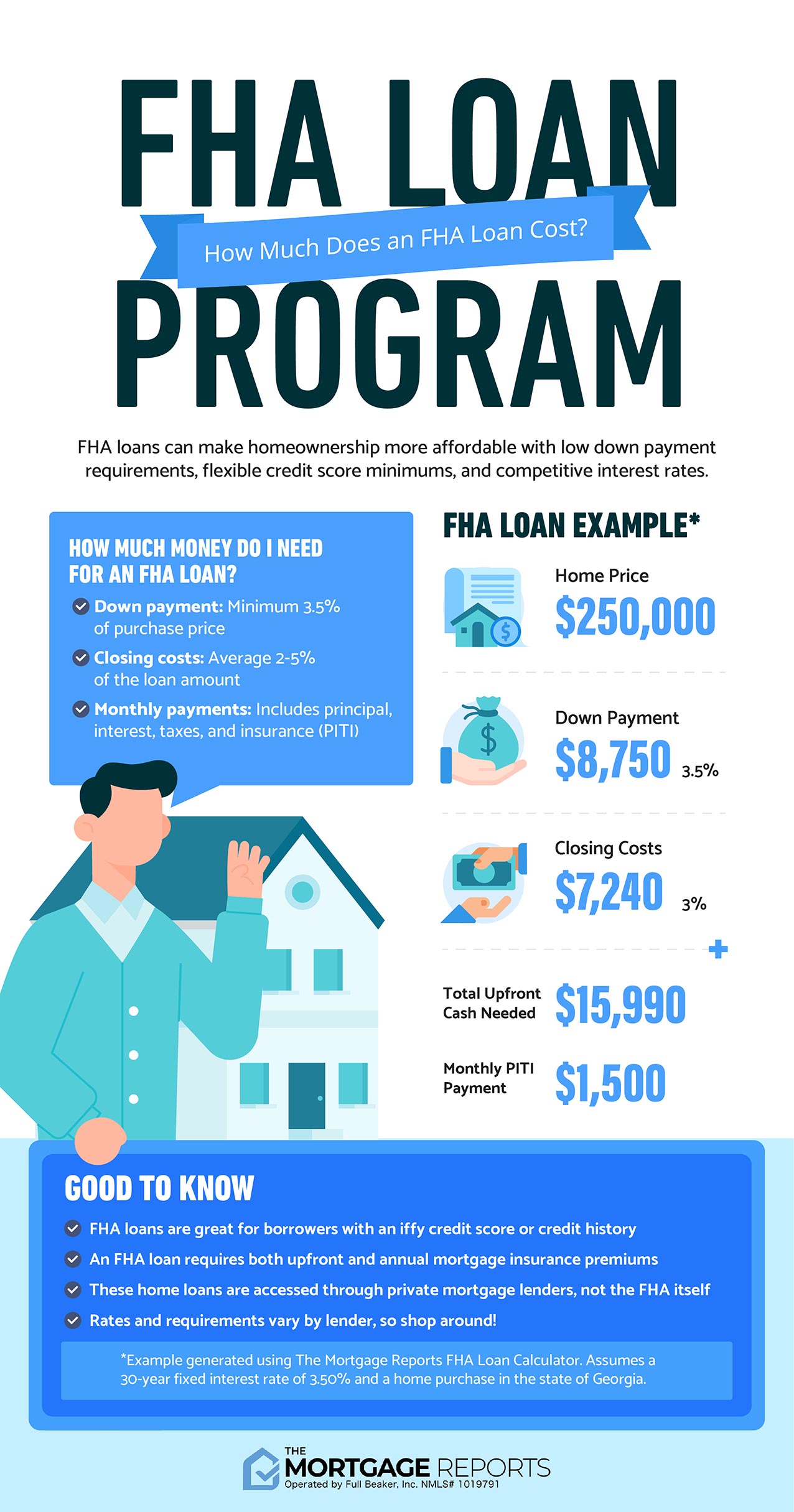

Fha Loan Calculator Check Your Fha Mortgage Payment

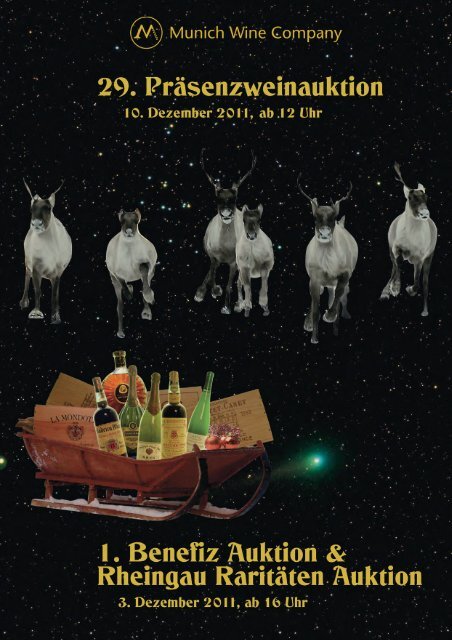

Auktion Erlesener Weine Amp Spirituosen Munich Wine Company