Prior depreciation calculator

How to Calculate Net Working Capital NWC The net working capital metric is a measure of liquidity that helps determine whether a company can pay off its current liabilities with its current assets on hand. Depreciation is not a freebie it is a loan Taxable gain at disposition consists of two parts.

Download Depreciation Calculator Excel Template Exceldatapro

Subtotal Prior to Application of Ownership Interest.

. Example of Price to Earnings Ratio. GDS using 200 declining balance. Special depreciation rules apply to listed.

Qualified GO Zone property placed in service before Dec. Hp 12c_users guide_English_HDPMBF12E44 Page. Is a property a good investment.

X Depreciation Rate 2020-27 and 2019-26 Total Mileage Depreciation Subtotal from Schedule C Business 1. This recapture rule applies to all personal property in the 3-year 5-year and 10-year classes. After 2017 the maximum depreciation amount.

Depreciation Calculators for preceding years are as under. Any fiscal year depreciation schedule is available on demand therefore any time consuming annual recalculations or year closings are eliminated. We also provide a Dilution Formula calculator with a downloadable excel template.

This is a guide to Dilution Formula. Each property is different and many factors must be considered when preparing a property depreciation schedule. Only - no need to type the date part separators.

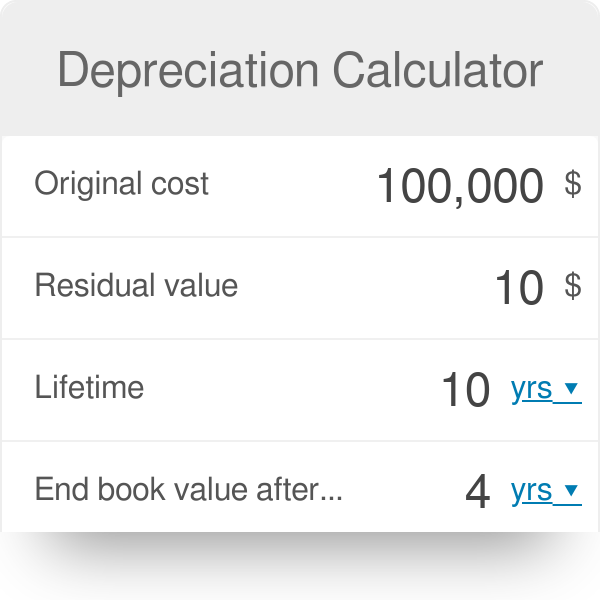

Increase in value of the asset appreciation inflation and reversal of prior depreciation deductions recapture These two parts are taxed differently resulting in. Some lenders will charge a fee when you pay off the balance prior to the final payment date to ensure that they can collect the. Use our 2022 Section 179 calculator to quickly calculate potential depreciation on qualifying business equipment office furniture technology software and other business items.

Such assets include mutual funds stocks and fixed deposits. Calculator and Quick Reference Guide. Form 91 Income Calculations.

Dont pay for a property depreciation estimate. Capital gains taxes and. Read more on investment ROI then raising the result to the power of reciprocity of the tenure of investment.

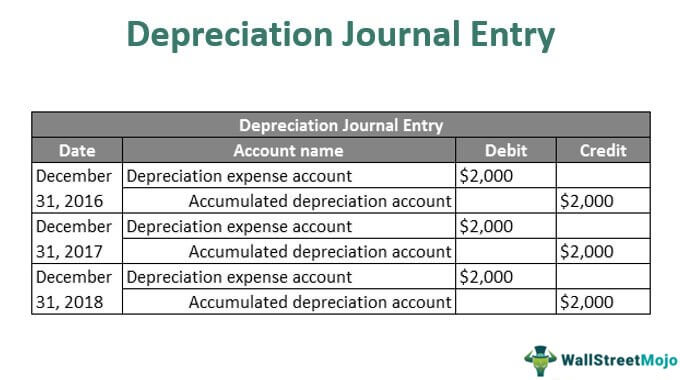

You take the depreciation for all capital assets for the current year and add to the accumulated depreciation on those assets for. The percentage of bonus depreciation phases down in the year. You must calculate depreciation on capital assets every year so you can include this depreciation cost on your business tax return.

4 of 209 Printered Date. W-2 Income from self-employment reported on IRS. Taxes are what we at JRW refer to as guaranteed losses and we attempt to defer or eliminate them wherever it is possible.

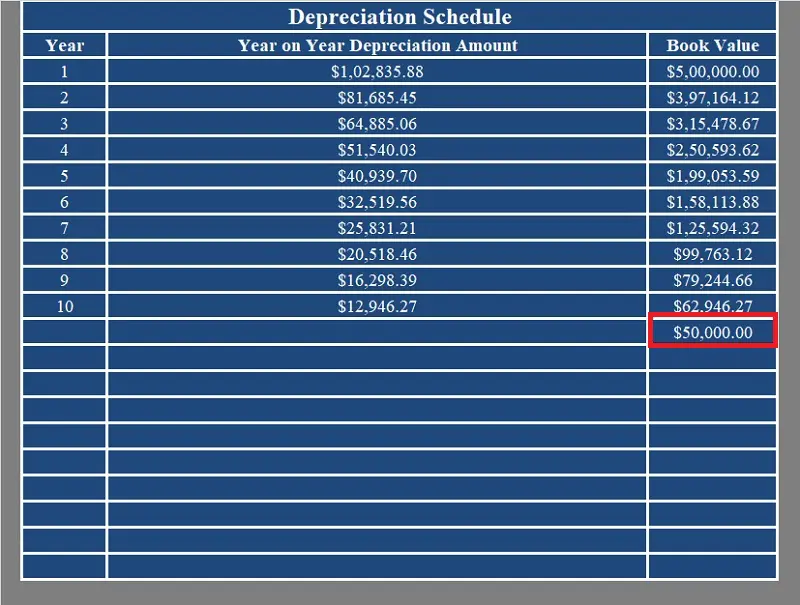

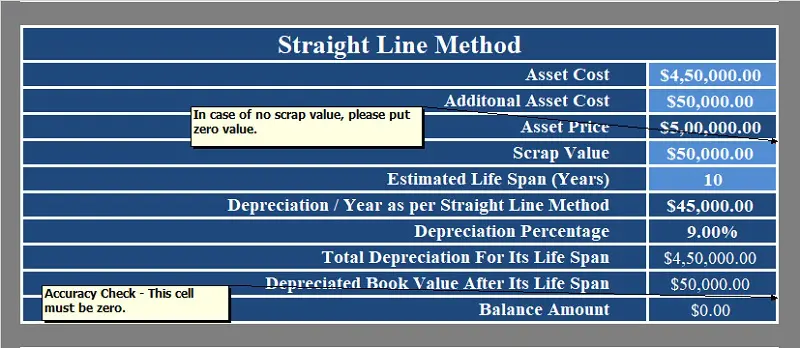

This approach is simple to implement in a depreciation schedule because the depreciation schedule will typically include a column for the book value. The 200 or double-declining depreciation simply means that the. The is similar in principle to the way amortization schedules adjust the last loan payment to account for prior rounding.

The new rules allow for 100 bonus expensing of assets that are new or used. Gain recognized on a disposition is ordinary income to the extent of prior depreciation deductions taken. Section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and first placed in service in 2021 is 18200 if the special depreciation allowance applies or 10200 if the special depreciation allowance does not apply.

Kisan Vikas Patra or KVP calculator is an effective tool for individuals willing to determine the maturity amount prior to investing. Depreciation rules for listed property. These properties might also qualify for a special depreciation allowance.

The Sales Tax Deduction Calculator IRSgovsalestax figures the amount you can claim if you itemize deductions on Schedule A Form 1040. Bonus depreciation allows qualifying businesses that spend more than the Section 179 limit to depreciate up to 100 on the remaining purchase amount. Type of Vehicle - The vehicle type impacts the amount of the maxiumum depreciation that a taxpayer can deduct each year prior to 2018.

This calculator will calculate both the IRR and Net. Depreciation inflation and more. Qualified Liberty Zone property placed in service before Jan.

You may also look at the following articles to learn more The formula for Diluted EPS. Also because the date is selected you do not need to clear the prior date before typing. Clicked continue and TurboTax calculated 45 in depreciation.

MACRS depreciation schedule gives you 3 methods under the GDS and 1 depreciation method under the ADS. Prepared as per Schedule-II. Certain property with a long production period.

Our fixed asset depreciation software has been in use by CPAs and small businesses since 1991. Adheres to IRS Pub. This tax depreciation method gives you a significant tax deduction in the earliest years.

I pick Appliances carpets and furniture then I can get to the screen that allows me to pick bonus depreciation but Appliances carpets and furniture appears to be for 5 year assets not 275 year assets. Free MACRS depreciation calculator with schedules. Not considering the depreciation of the recreational vehicle many buyers are so excited for the lower payments of a long-term loan that they dont consider the depreciation of the RV they are purchasing.

Upload reproduce republish distribute or transmit the utility except with the written prior approval. Depreciation is a tax term. If at step c.

I never got a screen with an option to pick bonus depreciation. 4 Introduction File name. If your selected date format equals mmddyyyy.

ABCAUS Excel Depreciation Calculator FY 2021-22 under Companies act 2013 latest version 0504 download. Read about the primary ways in which an investor can legally avoid capital gain taxesThese include the 1031 721 1033 tax-deferred real estate exchanges Deferred Sales Trust DST and various tax write-offs and credits. There are many such calculators available on different portals on the internet which are also extremely easy to use.

How to Calculate. In my opinion the best ones are free. Allows for 1 or 2 mortgages.

For qualified assets that were purchased new before September 28 2017 the old rules of 50 bonus depreciation still apply. There are several depreciation calculators on the market many of which can be found easily through a Google search for depreciation calculator. 148 cm x 21 cm z The various appendices describe additional details of calculator operation as well as warranty and service information.

This article would provide you with insights into several aspects of a KVP calculator. The formula can also be expressed by adding one to the absolute return Absolute Return Absolute return refers to the percentage of value appreciation or depreciation of an asset or fund over a certain period. Accumulated depreciation is an accounting term.

See Maximum Depreciation Deduction in chap-ter 5. These MACRS depreciation methods include. Supports Qualified property vehicle maximums 100 bonus safe harbor rules.

PART 3 - MACRS Depreciation Calculator. As a general rule the more current assets a company has on its balance sheet in relation to its current liabilities the lower its liquidity risk and the better off itll be. Here we discuss how to calculate Dilution Formula along with practical examples.

Print prior years depreciation schedules at any time by just entering the year to print. Warp speed depreciation is the type of depreciation that occurs the moment something goes from being new to being used The instant you sign the papers to become the proud owner of a brand new car the brand new car becomes a used car and the resale value plummets by as much as 20 of the purchase price.

Depreciation Schedule Formula And Calculator Excel Template

Macrs Depreciation Calculator Irs Publication 946

Depreciation Schedule Formula And Calculator Excel Template

Product Pricing Calculator Pricing Calculator Sample Resume Spreadsheet

Macrs Depreciation Calculator Straight Line Double Declining

Balance Sheet Simple Inside Business Balance Sheet Template Excel Balance Sheet Template Balance Sheet Business Plan Template Free

Depreciation Journal Entry Step By Step Examples

Download Depreciation Calculator Excel Template Exceldatapro

The Four Basic Financial Statements An Overview Statement Template Income Statement Financial Statement

Depreciation Calculator Definition Formula

Download Depreciation Calculator Excel Template Exceldatapro

Macrs Depreciation Calculator Straight Line Double Declining

Profit And Loss Statement Excel Template Profit And Loss Statement Statement Template Spreadsheet Template

Profit And Loss Template 07 Profit And Loss Statement Statement Template Spreadsheet Template

Depreciation Schedule Formula And Calculator Excel Template

Macrs Depreciation Calculator Based On Irs Publication 946

Depreciation Schedule Template For Straight Line And Declining Balance